When a firm grows in size, the volume of transactions that must be recorded and processed by the accounting information system also grows. As you now know, all business dealings are documented in the general journal, which is a chronological record of all such dealings. The general journal is where all of the day's transactions get written down. The general journal can become quite large and difficult to navigate as a result of this style of accounting, but it is accurate. Take the case of John Smith, who on June 1 was charged $100 for an item. The following would be recorded in the company's general journal, and subsequent entries would be made for all other transactions that occurred during the period. Scenario: On June 27 Mr. Smith inquires, "How much do I owe?

To identify all the sales transactions involving Mr. Smith, the corporation would have to go through roughly a month's worth of the general journal to get an answer to this query. What's more, if Mr. Smith were to say, "I thought I paid part of that two weeks ago," the business would have to scour the general diary to locate any entries pertaining to payments made to Mr. Smith. The general journal is where all financial activities, such as the payment of bills and the purchase of inventory, are documented in chronological order. This includes the 1,000 credit sales transactions that occurred during the month. As a result, it is difficult to locate the specific bits of information needed for one of our customers, Mr. Smith, if all transactions are recorded to the general journal. A well-designed accounting information system will make use of specialized journals and subsidiary ledgers to make it easier to retrieve specific kinds of data.

What are the 7 types of journal?

Unique Periodicals

Companies typically keep multiple specialized journals instead of a single general diary in which all business transactions are recorded. This streamlines the posting process and makes it simpler to search for specific types of transactions. The monthly totals from each special journal are posted to the main ledger once the month is through. In addition, businesses typically designate a single employee to record all transactions for a single specialized journal.

Most businesses make use of four specialized journals, but this number might rise or fall as necessary. The four most important specialized journals are the sales journal, the purchasing journal, the cash payments journal, and the cash receipts journal. Because some journal entries tend to be repeated, specialized diaries like these were developed. A typical entry in the cash receipts diary would show a debit to Cash and a credit to Sales for any sale of merchandise for cash. A sale of items on credit would also be entered in the sales journal with a corresponding debit to accounts receivable and a corresponding credit to sales. The second entry for a sale in a perpetual inventory system goes to cost of goods sold and the first goes to inventory.

The date the transaction occurred, the customer to whom it applies, the invoice number, which should correspond to the invoice number provided to the customer (whether in paper or electronic form), a reference box indicating that the transaction has been posted to the customer's account, which can be as simple as a check mark or as complex as a code that links the transaction to other journals and ledgers, and the last two digits of the customer's account number.

Cash disbursements are recorded in the cash disbursements journal as a debit to Accounts Payable (or another payable or expense) and a credit to Cash, while purchases of inventory on credit are recorded in the purchases journal as a debit to Merchandise Inventory and a credit to Accounts Payable.

A cash receipts diary is used to record the inflow of cash from the sale of goods, as payment on accounts receivable, or from other transactions, with a debit to cash and a credit to the account from where the cash was originally received.

What's going to keep all this in your head? In light of the adage "Cash Is King," we give preference to deals that can be settled in hard currency. The cash receipts notebook is where you record any and all cash transactions, regardless of their nature or size. Because cash was received, even if only a portion of a transaction, the entire sale would be recorded in the cash receipts log if it was for $1,000. The client would pay $300 in cash and agree to pay the rest $700 at a later date. There is no way to split this journal entry over two journals because the debits and credits of each transaction must add up to the same amount. You could split this sale into two sales, one for $300 in cash and one for $700 on account, but that would also be incorrect.

The numbers in the general ledger would add up to zero if you did that, but it's not the right way to handle things. To maintain proper internal controls, this transaction should be treated as a whole, documented in the cash receipts log, and tied to a single invoice number and date. The cash receipts diary is used to record all monetary transactions, regardless of how much cash was actually received. In this case, a debit of $300 from cash, a debit of $700 from Accounts Receivable, and a credit of $1,000 from Sales would be recorded in the cash receipts journal.

If any portion of a transaction is paid for in cash (often by check), the full transaction must be recorded in the cash disbursements log. Buying a building for $500,000 with a $100,000 down payment would be recorded in the cash disbursements journal as a credit to cash for $100,000, a credit to mortgage payable for $400,000, and a debit to buildings for $500,000.

The transaction will be documented in one of the other specialized journals rather than the general ledger if it does not include cash. Sales on account (also known as credit sales) are noted in the sales journal. It is documented in the purchasing diary if the transaction was made using credit (sometimes called a buy on account). If it does not fit any of these categories, it is written up in the regular journal.

Ledgers for Subsidiaries

In addition to the aforementioned four specialized journals, a secondary ledger for both accounts receivable and payable is maintained. As can be seen in Figure 7.13, the accounts receivable subsidiary ledger includes information about all customers that owe money to the business. Each customer's account is represented by a different colored block, and only their particular debt to the business is displayed. Note that the subsidiary ledger includes the due amounts in the debit column and the paid amounts in the credit column, as well as the transaction date and a reference column that connects the entry to the same information posted in one of the special journals (or general journal if special journals are not used). The Accounts Receivable Control Total is calculated by adding together all of the individual receivable amounts from the subsidiary ledger, and it should balance with the Accounts Receivable balance provided in the main ledger.

The grand total of receivables is recorded in the general ledger as accounts receivable, which is derived from the subtotals recorded in the subsidiary ledger.

The subsidiary ledger for accounts receivable must balance with the main ledger for accounts receivable, which is the total amount owed to the company.

All of a company's outstanding debts to individuals and other businesses are recorded in a sub-ledger called accounts payable.

Each vendor (the business or individual from whom you've acquired goods) will have their own entry in the accounts payable subsidiary ledger. The date an entry was made, a reference column utilized in the same way as indicated for accounts receivable subsidiary ledgers, and the amount charged or paid are all elements shared by the purchases subsidiary journal and the accounts receivable subsidiary ledger. Both ABC and XYZ Corporations' business deals are detailed below. Each subsidiary's purchases journal will have a final balance showing the amount owed to ABC and XYZ. Adding these sums together will reveal a total debt to these two firms of $305. The $305 will be posted to the general ledger account designated for payables.

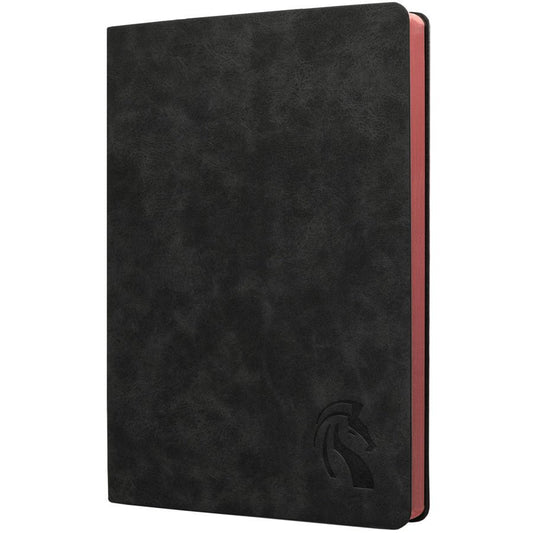

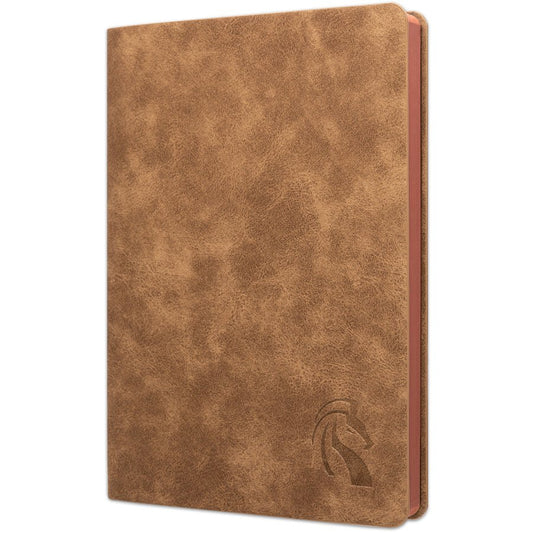

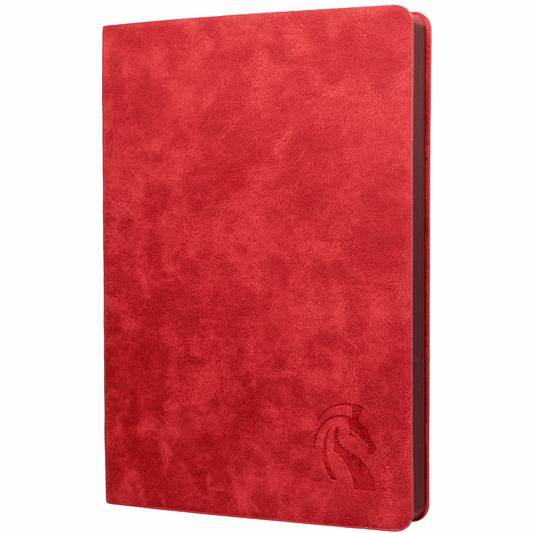

LeStallion PU Leather Journals

LeStallion Soft Cover PU Leather Journals inspires and excites you to write more, allow you to further grow and develop, so you may achieve your goals and dreams!

SHOP LESTALLION