What exactly is the purpose of an accounting journal?

A journal is a type of book that is used to record various events, including financial ones.

It is also referred to as the "book of original entry" since it is the place in a company's accounting system where transactions are initially recorded.

What are the best journals for men?

Journals can be used for any kind of record-keeping that is performed on a regular basis, including tracking business records, keeping tabs on investments, developing budgets, managing day-to-day finances such as receipts and expenses (including information regarding profits and losses), and creating budgets.

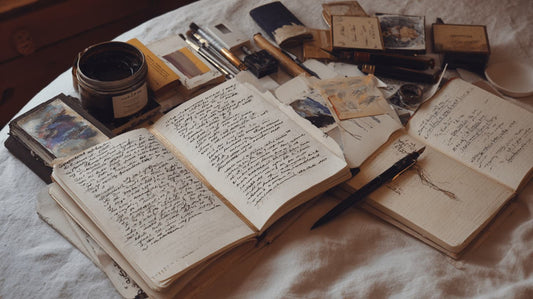

What do you do with a journal?

It's possible that some businesses are still utilizing manual accounting methods, while others have switched to using computerized accounting systems. Whatever the case may be, journals continue to serve an essential purpose because they are used to record many types of transactions.

Following the completion of a financial transaction, the bookkeeper will enter the details of the transaction into the diary and will then create a journal entry.

The record will include specifics regarding the date when the transaction was carried out, the accounts that were impacted by the financial transaction, the matching sums involved for each account that was impacted, as well as a concise explanation to back up the transaction.

For the purposes of accounting, regularly maintained journals are also crucial since they give information about the amounts of money that are deposited into and withdrawn from the bank account associated with your firm.

Different Kinds of Journals

When keeping their books using the double-entry method, most businesses maintain seven distinct kinds of accounting journals.

This is done in order to further organize the different types of transactions into the particular journal type for which they are appropriate. If the transactions were recorded in a single journal, then the impact of those transactions would be more difficult to assess than if they were documented in multiple journals.

The following are the seven different types of accounting journals:

Purchase Journal

When a credit purchase of merchandise or inventory is made, the transaction details are documented in the purchase journal.

Because of this, the transactions recorded in this form of notebook are not allowed to include things like the purchase of assets using credit, as this should only be used for recording items or inventory.

Additionally, purchases of items or inventory made with cash ought not to be documented in this diary because it is reserved solely for transactions involving credit.

Journal of Purchases and Returns:

This kind of journal is used to record all returns of stock that was paid for with credit at the time of purchase.

Take notice that you won't be able to put any inventory returns into this notebook if the cash was used to pay for the original transaction.

a journal for recording cash receipts :

All cash receipts, which might be payments from consumers for a service or product that you sell, are documented in the cash receipts journal. This could be because the cash receipts journal is where all cash receipts are recorded. In addition to debtors, income, or loans received, other potential sources of cash could also be considered. However, this list is not exhaustive.

In this section, one might record things like customer payments and bank deposits, among other things.

Journal of Cash Withdrawals and Expenditures:

In the cash disbursements journal, you will make a record of every payment that you make to your debtors using cash.

This comprises payments for a variety of expenses, such as mortgage payments, interest on loans, bills from suppliers, and payroll.

The "cash payments journal" is another name for the cash disbursements journal, which is another name for it.

Take into consideration the possibility that some businesses maintain separate journals for each sort of expense category that they deal with in order to facilitate more accurate cost tracking.

Sales Journal:

This diary keeps a record of all credit sales of merchandise.

The Cash Receipts Journal is where you should record the sales that were made to customers who paid in cash. You should not record those sales here.

Sales Returns Journal:

When a credit return of merchandise or inventory is made, the entry will be made in this diary.

Additionally, if the things were initially purchased with cash and returned for credit, they should not be noted here but rather in the Purchase Returns Journal. This is because the cash was used to pay for the original purchase.

Journal of General Studies:

The generic journal is the one in which one should record any and all journal entries that do not correspond to any of the six other types of journals described above.

The purchase of an asset using credit is one example of a financial transaction that could be documented in this section of the ledger.

This is also where we provide information about credits and debits so that we can construct a complete accounting system for recording transactions using double-entry bookkeeping. This is done so that we can produce an accurate financial picture.

Journals and ledgers are both valuable instruments in bookkeeping; nevertheless, each of these serves a unique purpose and has its own set of applications.

A journal is the primary location for the initial recording of a financial transaction, as was previously noted. On the other side, the outcomes of the transactions are recorded in a ledger so that they may be accessed at any time.

During the process of getting ready, each and every monetary transaction will have to be entered into the journal first, and only then will they be transferred into the ledger.

The following are some key distinctions between a journal and a ledger that you should keep in mind:

A Few Parting Thoughts

In accounting, the journal is a highly significant instrument that is used. This kind of record-keeping, which may at first glance appear to be relatively straightforward, actually has the potential to be an extremely beneficial asset for your company.Journals are the books that are utilized by enterprises and companies in order to keep track of the financial transactions that have taken place.

They are significant data sources that can be evaluated to gain useful financial insights into the operations, profitability, and cash flow state of a business.

Just be sure to keep these things in mind, and always remember to utilize journals correctly, so that you won't have to deal with any difficulties when you're doing your homework.

What are the most common kinds of academic journals?

There are seven distinct varieties of journals, including general, buy, purchase returns, cash receipts, cash disbursements, sales, and sales returns.

What exactly is the goal of keeping a general journal?

When recording information that is not part of a specific transaction, that information will be done so in the general journal. Things like mortgage or rent payments, as well as interest on loans, are included in this category.

When I finally get my business off the ground, will I have a need for a ledger?

You are free to decide for yourself whether or not you want to keep a ledger. Everything hinges on what you and your organization consider to be the most practical and helpful way to handle your accounting transactions. It is also an option for you to collaborate with both of them, however this will depend on the level of specificity required for your financial data.

How do I make an entry in my journal that is generic in nature?

Following the completion of a financial transaction, the bookkeeper will enter the details of the transaction into the diary and will then create a journal entry. The record will include specifics regarding the date when the transaction was carried out, the accounts that were impacted by the financial transaction, the matching sums involved for each account that was impacted, as well as a concise explanation to back up the transaction.

Why is keeping a journal necessary?

The journal is significant due to the fact that it is the initial location where any information pertaining to your company is recorded. This will assist you in keeping track of all of these transactions and gaining a better understanding of the current financial standing of your company. You can also use journals to monitor specific things, such as the movement of cash, the amounts of goods, and the status of accounts receivable or payable.

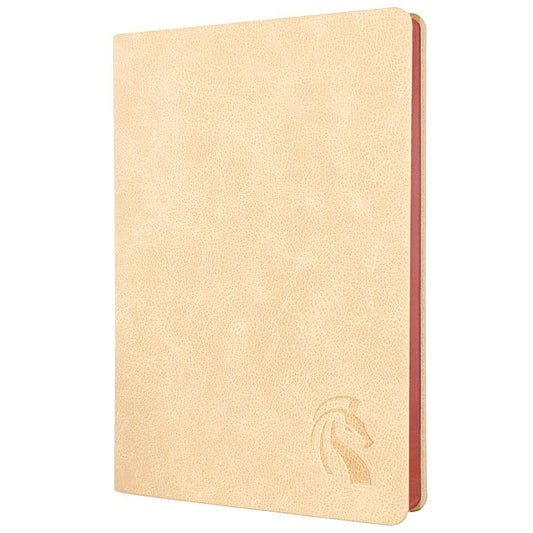

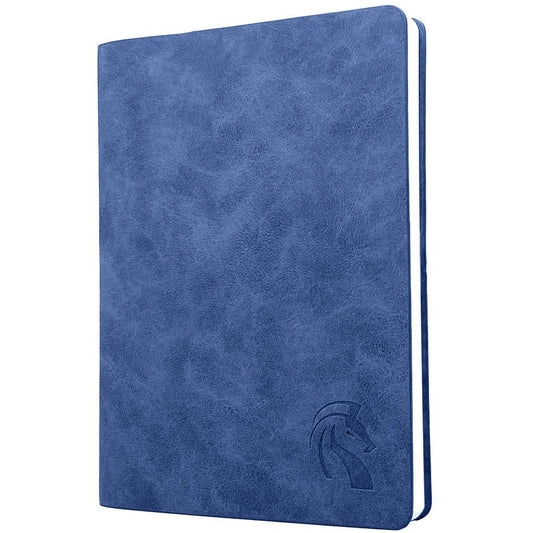

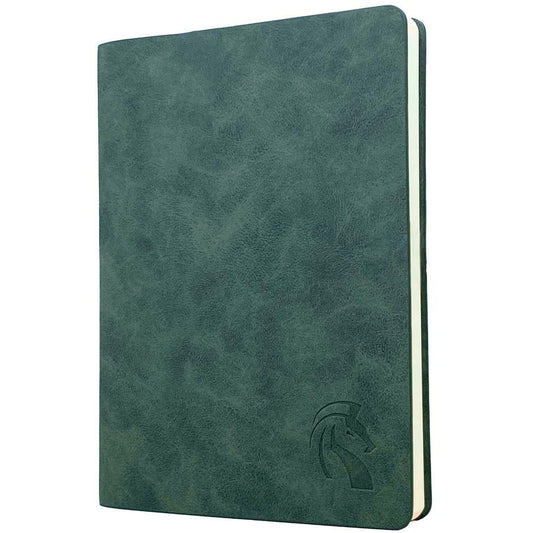

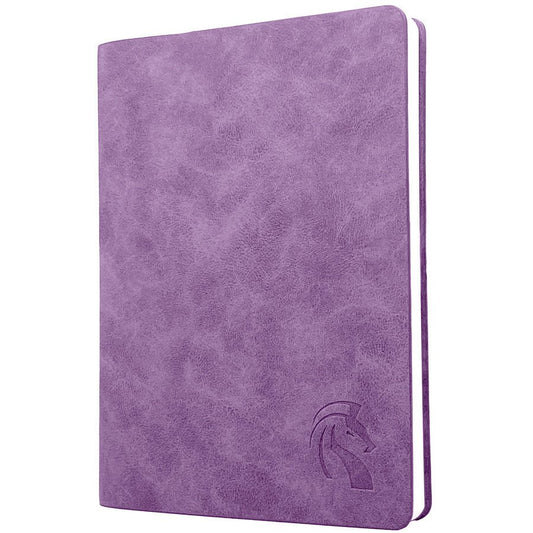

LeStallion PU Leather Journals

LeStallion Soft Cover PU Leather Journals inspires and excites you to write more, allow you to further grow and develop, so you may achieve your goals and dreams!

SHOP LESTALLION