A5 Soft Cover Faux Leather Journal Notebook For Budgeting and Finance

-

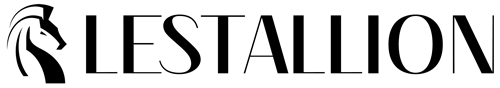

ARIEGEOIS | Ashgray Black - A5 Lined Journal Notebook

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSale -

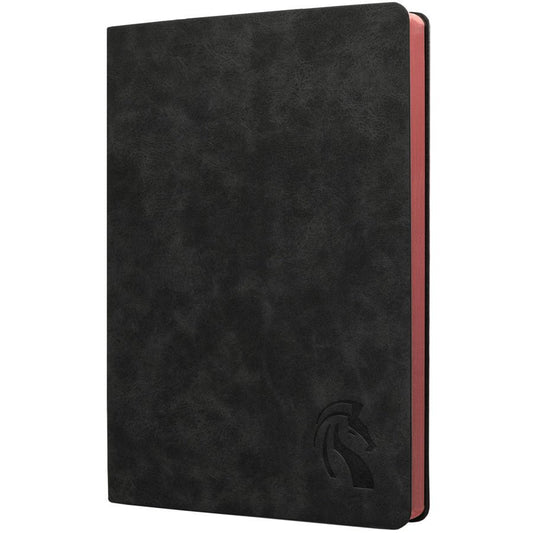

GARRANO | Cocoa Brown - A5 Lined Journal Notebook

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSale -

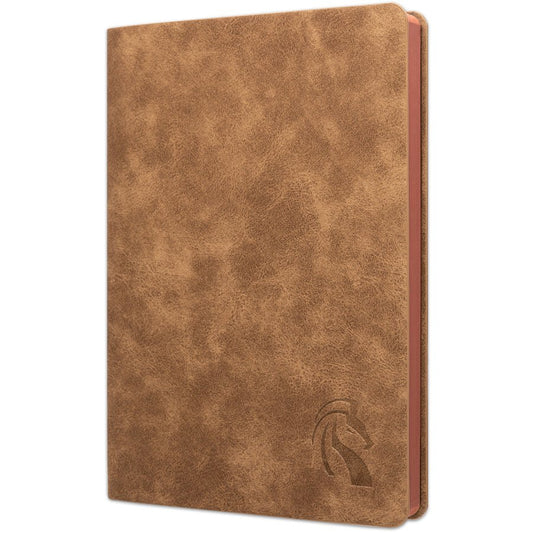

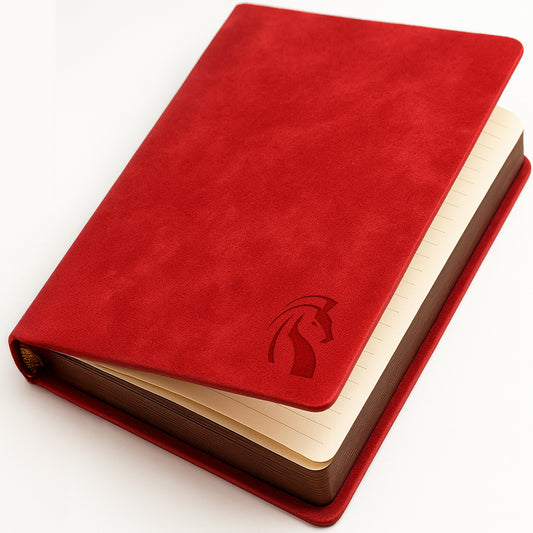

CASPIAN | Royal Red - A5 Lined Journal - Soft Cover

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSold out -

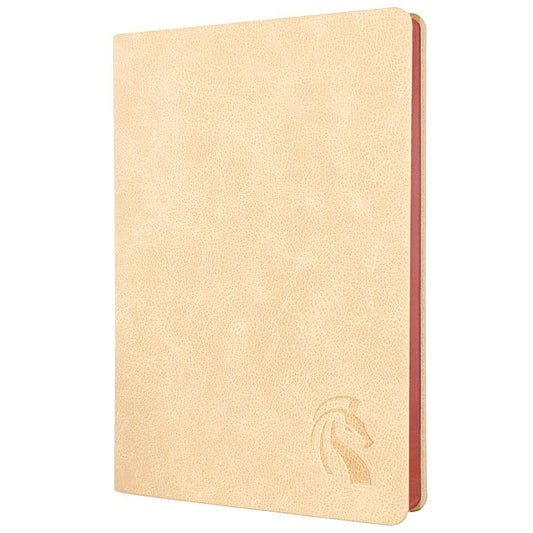

GALLOWAY | Khaki Cream - A5 Lined Journal Notebook

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSale -

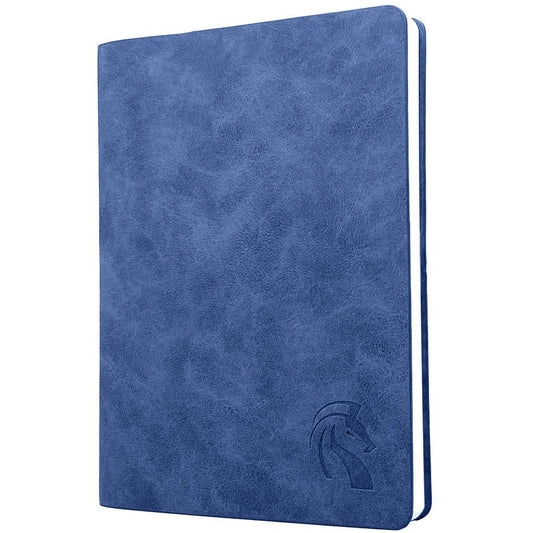

ROAN | Royal Blue - A5 Lined Journal

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSale -

JENNET | Juniper Green - A5 Lined Journal Notebook

Regular price $24.95 USDRegular priceUnit price per$30.00 USDSale price $24.95 USDSale -

CHAROLAIS | Grape Purple - A5 Lined Journal Notebook

Regular price $30.00 USDRegular priceUnit price per -

GYPSY | Rosaye Pink - A5 Lined Journal Notebook

Regular price $30.00 USDRegular priceUnit price per -

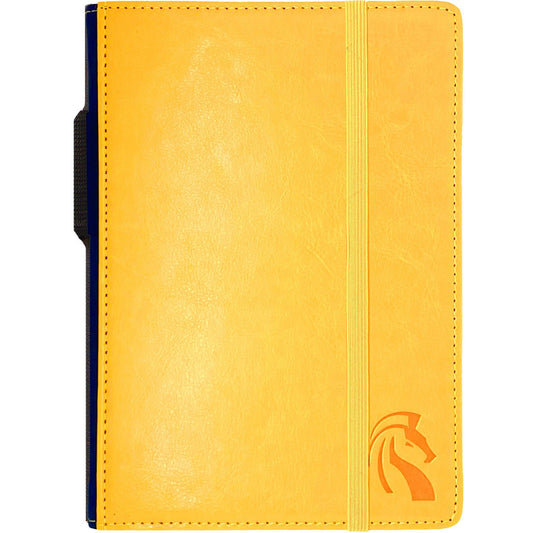

AKHALTEKE | Ochre Yellow - A5 Lined Journal Notebook

Regular price $30.00 USDRegular priceUnit price per

A5 Hard Cover Faux Leather Journal Notebook For Budgeting and Finance

-

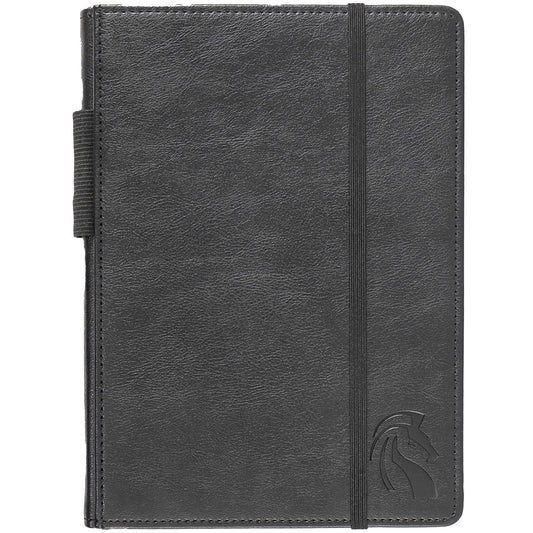

A5 Hardcover Journal Notebook - Black Faux Leather

Regular price $22.95 USDRegular priceUnit price per$25.00 USDSale price $22.95 USDSale -

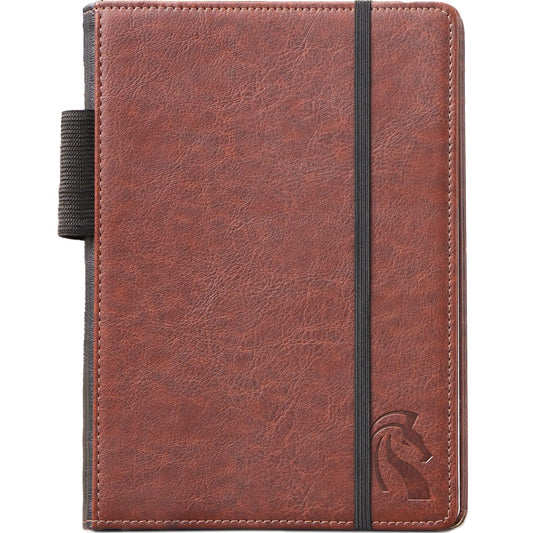

Classic Brown | Brown Journal Notebook | A5 Hardcover Faux Leather

Regular price $22.95 USDRegular priceUnit price per$25.00 USDSale price $22.95 USDSale -

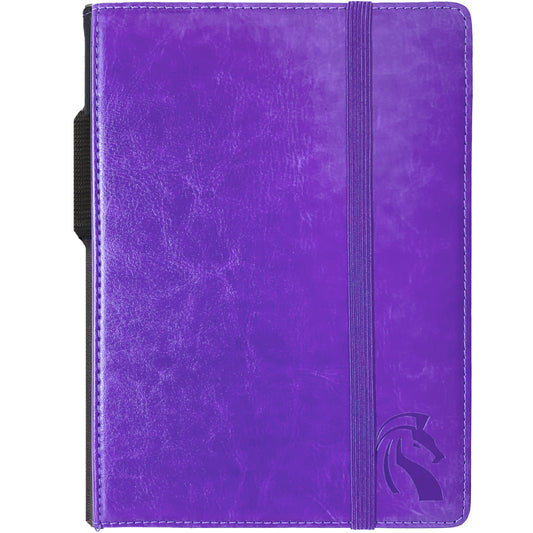

Proactive Purple | Purple Journal Notebook | A5 Hardcover Faux Leather

Regular price $19.95 USDRegular priceUnit price per$25.00 USDSale price $19.95 USDSold out -

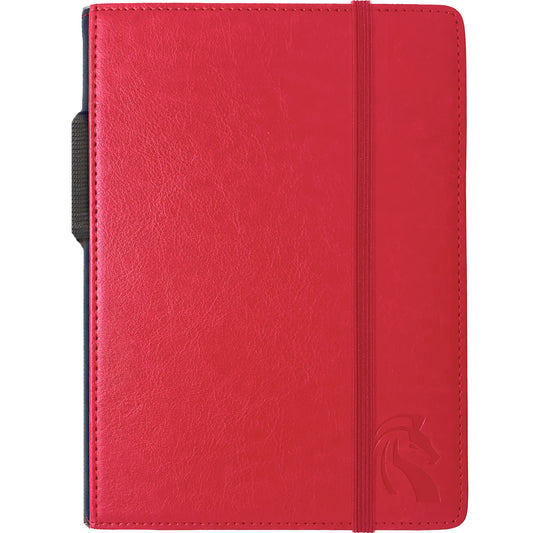

Visionary Red | Red Journal Notebook | A5 Hardcover Faux Leather

Regular price $19.95 USDRegular priceUnit price per$25.00 USDSale price $19.95 USDSale -

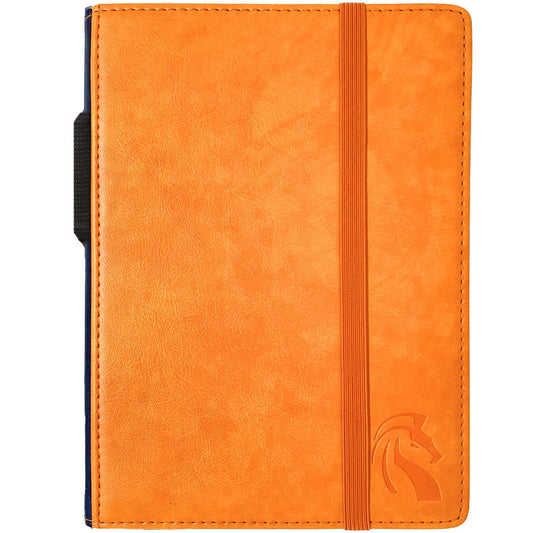

Optimist Orange | Orange Journal Notebook | A5 Hardcover Faux Leather

Regular price $25.00 USDRegular priceUnit price per -

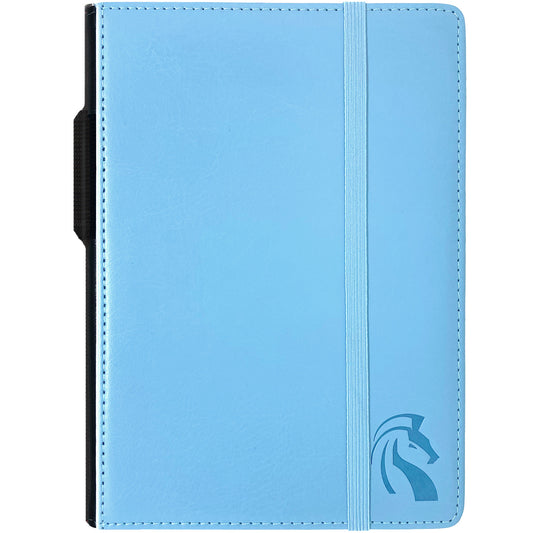

Clarity Blue | Light Baby Blue Journal Notebook | A5 Hardcover Faux Leather

Regular price $19.95 USDRegular priceUnit price per$25.00 USDSale price $19.95 USDSale -

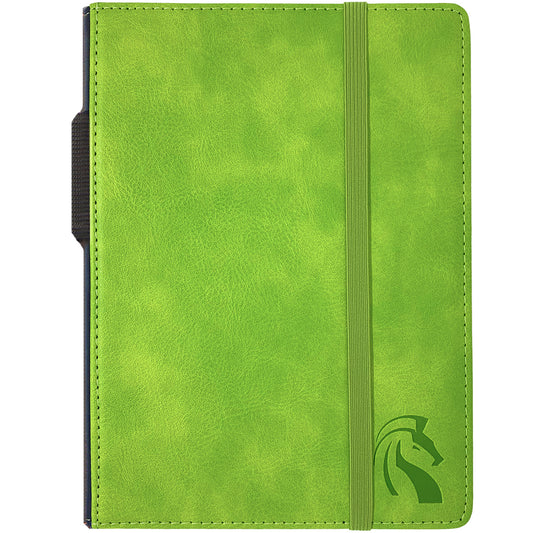

Growthful Green | Green Journal Notebook | A5 Hardcover Faux Leather

Regular price $25.00 USDRegular priceUnit price per -

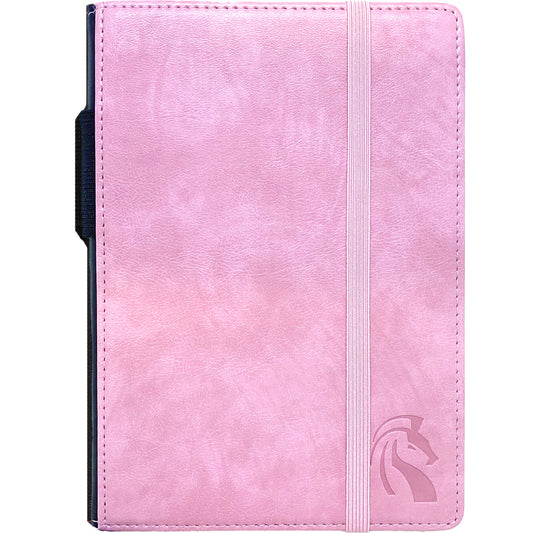

Passionate Pink | Pink Journal Notebook | A5 Hardcover Faux Leather

Regular price $19.95 USDRegular priceUnit price per$25.00 USDSale price $19.95 USDSold out -

Ambition Yellow | Yellow Journal Notebook | A5 Hardcover Faux Leather

Regular price $25.00 USDRegular priceUnit price per

Why Budgeting Needs a Journal Notebook

Budgeting is an essential skill for managing your finances effectively. Yet, many individuals find themselves overwhelmed by tracking expenses, setting financial goals, and managing debts. Without a structured approach, it’s easy to lose sight of where your money goes.

A journal notebook tailored for budgeting provides a dedicated space to organize your financial plans. From recording daily expenses to setting long-term goals, it transforms abstract ideas into actionable steps. Using a journal, like the ones from LeStallion, ensures you stay on top of your finances with style and efficiency.

Features That Make a Journal Notebook Ideal for Budgeting

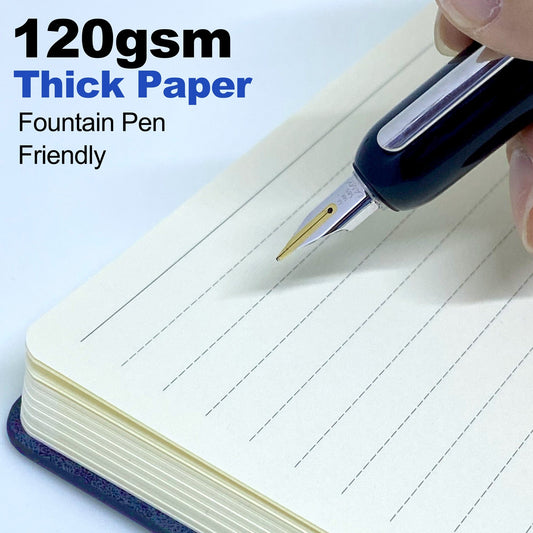

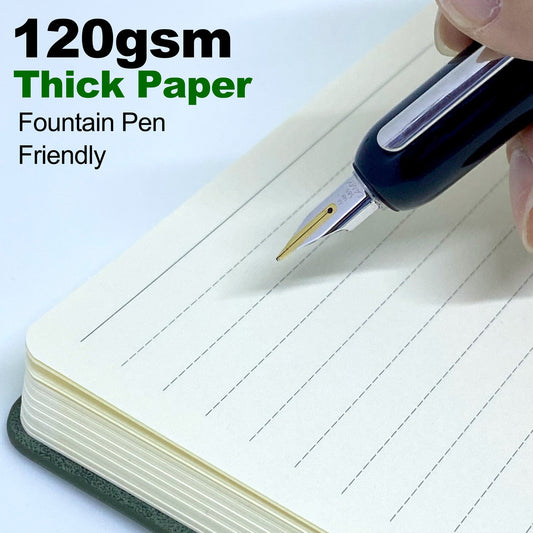

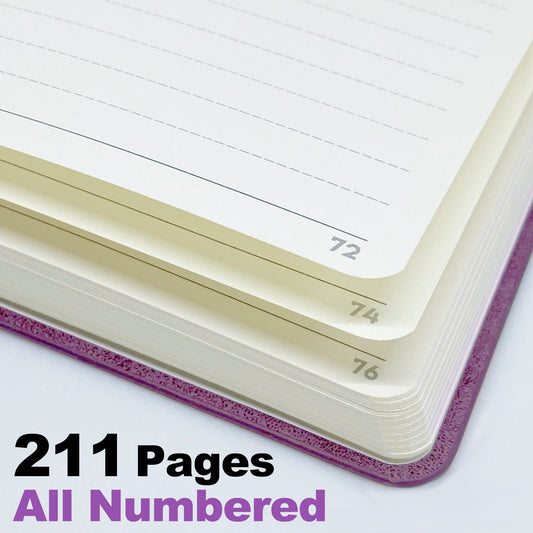

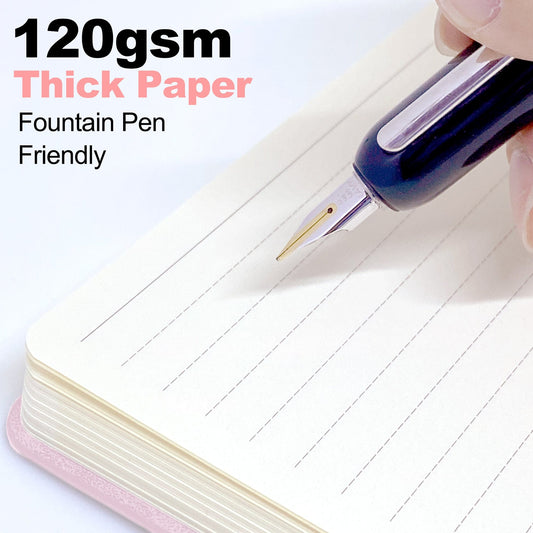

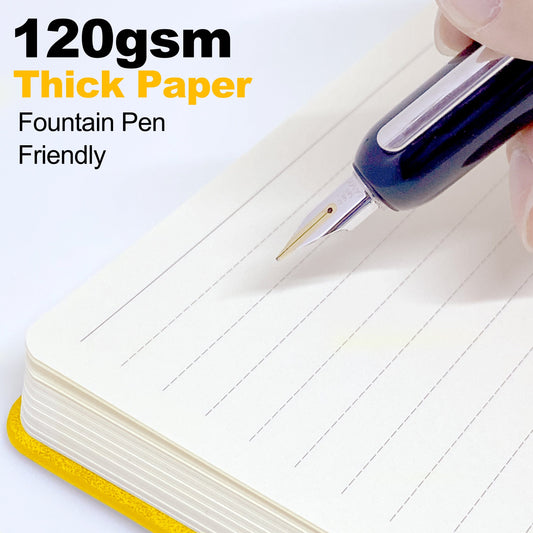

A high-quality journal notebook is designed to make budgeting both effective and enjoyable. Features like thick 120GSM wood-free paper ensure smooth writing without ink bleed-through, making it ideal for color-coded expense tracking.

LeStallion journals offer 211 numbered pages, providing ample space for detailed entries. A built-in table of contents makes it easy to revisit critical data, whether you’re reviewing monthly expenses or planning future savings. The dashed-lined pages and 7.5mm spacing allow flexibility for writing, drawing trackers, or sticking reminders.

Other useful features include:

- Back pockets for storing receipts or bill reminders.

- A soft faux leather cover for durability and a professional look.

- Compact size, making it easy to carry for on-the-go financial planning.

Common Budgeting Challenges and How a Journal Notebook Helps

One of the biggest hurdles in budgeting is managing multiple aspects like tracking expenses, setting goals, and staying consistent. Common challenges include:

- Overspending due to lack of awareness about daily expenses.

- Forgetting bill deadlines, leading to late fees.

- Feeling overwhelmed by the complexity of managing financial data.

A journal notebook addresses these challenges by providing a structured system. For instance, you can dedicate specific pages for:

- Monthly expense trackers to monitor spending habits.

- A bill calendar for payment reminders.

- A section for listing debts and mapping out repayment strategies.

LeStallion’s journals, with their durable construction and clear layouts, ensure that financial organization becomes a seamless part of your routine.

Emily’s Story: Transforming Finances With a Budget Journal

Emily, a freelance designer, struggled with irregular income and overspending on non-essentials. Her financial stress grew as she juggled overdue bills and mounting credit card debt. Desperate for a solution, she purchased a LeStallion journal notebook to take charge of her finances.

She started by listing all her income and expenses. With the numbered pages and built-in table of contents, she categorized her spending into needs, wants, and savings. She used the dashed-lined pages to create visual graphs, like monthly spending vs. saving.

Over time, Emily began to notice patterns—such as spending too much on dining out. She adjusted her habits, tracked progress, and even added motivational quotes to her journal. Six months later, Emily cleared 50% of her debt, built a small savings fund, and gained confidence in her financial decisions. Her journey showcases the power of a well-designed budget journal in achieving financial freedom.

How to Journal Effectively for Budgeting and Finance

Creating an efficient budgeting journal requires a mix of structure and creativity. Here’s how to get started:

- Set Financial Goals

Write down both short-term and long-term goals, such as saving for a vacation or paying off a loan. - Track Income and Expenses

Dedicate pages for income streams and daily expenses. Use color codes to differentiate categories. - Use Monthly Trackers

Create a calendar-style layout to note bill due dates and expense summaries. - Incorporate Savings Challenges

Dedicate a section to track savings growth using graphs or creative designs. - Review Progress Regularly

At the end of each month, reflect on spending habits and adjust your plans accordingly.

Additional ideas to personalize your budget journal:

- Use stickers or washi tape to highlight key areas.

- Add motivational affirmations to stay inspired.

- Reserve a gratitude page to celebrate financial milestones.

LeStallion’s premium paper and sleek design make this process smooth and enjoyable, ensuring you stay motivated throughout your financial journey.

The Benefits of a Journal Notebook for Financial Literacy

Journaling for budgeting extends beyond money management—it cultivates financial literacy. This habit encourages self-discipline, thoughtful decision-making, and a clear understanding of financial priorities.

Key benefits include:

- Building positive habits: Tracking spending helps eliminate wasteful habits.

- Promoting accountability: Writing down financial goals fosters commitment.

- Encouraging mindfulness: Regular journaling shifts focus from stress to actionable solutions.

LeStallion journals, with their faux leather cover and compact size, offer the ideal companion for anyone seeking financial clarity. Their professional appearance makes them equally suited for work meetings or personal use.

Achieving Financial Success Through Budget Journaling

Consistent use of a budget journal can lead to transformative results, such as achieving savings goals, reducing debt, and building financial independence. Imagine flipping through pages filled with progress graphs, expense trackers, and motivational notes.

The rewarding results of a dedicated journal notebook include:

- Improved financial confidence: Gain clarity on where your money goes and take control of spending.

- Debt reduction: Track and prioritize debt payments using the snowball method or debt avalanche strategies.

- Long-term growth: Plan for investments, retirement, or other financial milestones.

LeStallion’s 211 pages and pocket-friendly design ensure you have ample space for both daily entries and long-term plans, making your financial journey seamless and successful.