The term "financial accounting" refers to much more than simple bookkeeping. Every transaction requires two entries in the books of accounting: a debit one and a credit one. It is essential to determine which account needs to have a credit applied to it and which account needs a debit applied to it.

The accounting method known as dual entry looks like this: The discipline of financial accounting is predicated on three guidelines, which are collectively referred to as the golden principles of accounting. These golden standards ensure that all financial transactions are recorded in a methodical manner. The golden rules condense the intricate laws of bookkeeping into a collection of concepts that can be comprehended, learned, and put into practice with relative ease.

Different Kinds of Accounts

The "golden rules" of accounting are a set of guidelines that should be followed while recording financial transactions in ledgers. The golden rules differ depending on the kind of account you have. Each transaction will be recorded as both a debit and a credit entry, and it will be associated with one of the three types of accounts that are listed below:

The Genuine Article

Individual Login Area

Account in Nominal Form

The Genuine Article

A real account is a type of account in the general ledger that details all of the transactions that are associated with assets and liabilities. It includes both actual and intangible assets in its scope. Real property, including but not limited to: furniture, land, buildings, machinery, etc. On the other side, intangible assets are those that cannot be physically touched, such as a company's goodwill, copyright, patents, etc.

What are the 7 types of journal?

The real accounts are carried forward to the following year, and as a result, the real accounts are not closed at the conclusion of the financial year. In addition to that, the balance sheet reveals the existence of an actual account. One variety of actual account is known as a "furniture account."

Individual Login Area

A general ledger account that pertains to individuals is referred to as a personal account. It could be natural persons such as humans, or it could be artificial persons such as companies, firms, associations, and so on. When one firm, company A, receives money or credit from another company or individual, company A is considered the recipient of the funds or credit. And in the case of a personal account, the other company or individual who gives it is considered the giver rather than the recipient. One variety of personal account is known as a creditor account.

The following is a list of the several kinds of personal accounts:

The term "artificial personal account" refers to a sort of account that is used to represent legal entities that, according to the law, are not recognized to be human people. Hospitals, banks, partnerships, government agencies, and other types of organizations are all examples of false personal accounts.

This is a representation of human people, the natural personal account. Such terms as "creditor" and "debtor" as well as "capital account" and "drawings account" are examples.

Personal Representative Account: This account serves as a representative for the financial activities of both natural and artificial entities. All of the transactions in this account either pertain to the previous year or to the year that is to follow. Take, for instance, income that has been pulled in advance, or compensation that is owed from years gone by, etc.

Account in Nominal Form

A general ledger account that tracks all of an organization's income, expenses, profits, and losses is referred to as a nominal account. It gives an account of every transaction that occurred inside a single fiscal year. As a direct consequence of this, the balances have been wiped clean and a new beginning can be made. One variety of nominal account is known as an interest account.

The Three Most Important Accounting Principles

The foundation of good bookkeeping is found in the golden rules of account. You are required to choose the appropriate type of account for each transaction in order to adhere to the golden standards of accounting. Every single transaction must adhere to its own individual set of guidelines, which are dictated by the type of account being used. The three most important guidelines in accounting are as follows:

Rule 1: Whatever comes in should be deducted, and whatever leaves should be credited.

Only actual accounts are subject to this regulation. Real accounting take into consideration things like furniture, land, buildings, machinery, and so on. They are set up with a negative balance by default. As a consequence of this, deducting the amounts that are coming in results in an increase to the existing balance in the account. Likewise, when a tangible asset is removed from the company, the account balance is decreased since credit is given for what is removed.

The second rule is to subtract from the recipient and add to the giver.

This guideline pertains to one's own personal finances. When a real or fictitious person gives something to the organization, that contribution is considered an inflow, and the donor needs to be acknowledged in the financial records. On the other hand, a debit must be applied to the receiver.

Rule 3 states that one must subtract one's expenditures and losses and add one's income and gains.

This regulation applies to accounts that use nominal values. The capital that a firm has is considered to be a liability. As a direct consequence of this, it has a positive balance. A rise in capital will result from include all of the income and gains in accounting for it. On the other hand, when expenses and losses are debited from the account, the capital decreases.

Several Positive Aspects of Accounting's Golden Rule.

The following are some of the benefits that come with adhering to accounting's golden rules:

Maintaining Accurate Books of Accounts By adhering to the "golden principles" of accounting, one can ensure that business records and corporate accounts are maintained in an accurate and consistent manner.

The management of the company is in a position to easily evaluate the company's success over the years because the records have been kept in good condition.

When completing an evaluation of a firm, these financial statements will be helpful in gaining an understanding of the revenues and expenses of the organization being evaluated.

Keeping accurate records of the company's financial transactions and accounting practices is essential not only for accurate budgeting but also for accurate estimation of the company's future expectations.Taxation and Regulatory Matters: If you follow the "golden rules" of accounting, you will be able to prevent any shortages in tax and regulatory issues. Any lack of discipline in accounting will result in fines and other regulatory issues.

Conclusion

The preparation of financial accounts relies heavily on adhering to the "golden rules" of accounting. Each and every transaction needs to be recorded by the organization. Each transaction is initially entered into a journal, and then it is entered into a ledger. Find out which account each transaction belongs to, and only after that should you make journal entries using the three golden rules. For this reason, it is essential to have a solid understanding of the fundamental accounting principles known as the "golden standards."

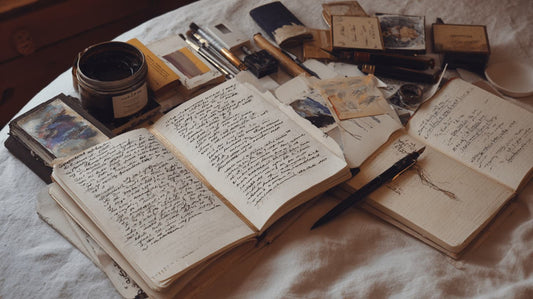

LeStallion PU Leather Journals

LeStallion Soft Cover PU Leather Journals inspires and excites you to write more, allow you to further grow and develop, so you may achieve your goals and dreams!

SHOP LESTALLION