1

Express Accounts Pro Business Expense Tracking Software

Brand: NCH Software

Features / Highlights

- Tracks business expenses, income, invoices, and payments in one system.

- Generates profit, loss, sales, and expense reports with minimal setup required.

- Supports integration with multiple users and role-based permissions.

- Works on both Windows and Mac, increasing accessibility in mixed device environments.

- Allows easy export and backup of financial records for audits and bookkeeping.

CHECK PRICE

2

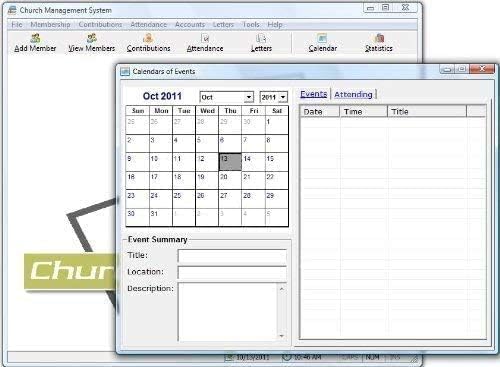

CampusPro Expense & Facilities Management Software

Brand: School Management Professional

Features / Highlights

- Centralizes facility records, financial logs, and administrative data in one platform.

- Tracks school or organization expenses across multiple operational categories.

- Offers bookkeeping functions suitable for budgeting and internal reporting.

- Allows multiple user access for distributed administrative roles.

- Designed for academic institutions and organizations that manage shared resources.

CHECK PRICE

3

ProManage Suite Property & Expense Tracking Software

Brand: Software Innovations

Features / Highlights

- Centralizes rental income, maintenance expenses, and tenant billing records.

- Includes smartphone companion app for updates and logging on the go.

- Tracks multiple rental units with individual financial records.

- Generates expense, revenue, and unit profitability reports.

- Supports lease document management and tenant profile organization.

CHECK PRICE

4

ProSuite 2024 Business Expense & Office Tools (PC Download)

Brand: eSoft

Features / Highlights

- Compatible with Word, Excel, and PowerPoint style file formats for smoother workflow continuity

- Designed for small businesses that need unified document and expense recording tools

- One-time purchase without ongoing monthly subscription fees

- Works on Windows PCs without heavy installation requirementsWorks on Windows PCs without heavy installation requirements

- Useful for teams that want consistent formatting, simple budgeting sheets, and organized office documentation

CHECK PRICE

5

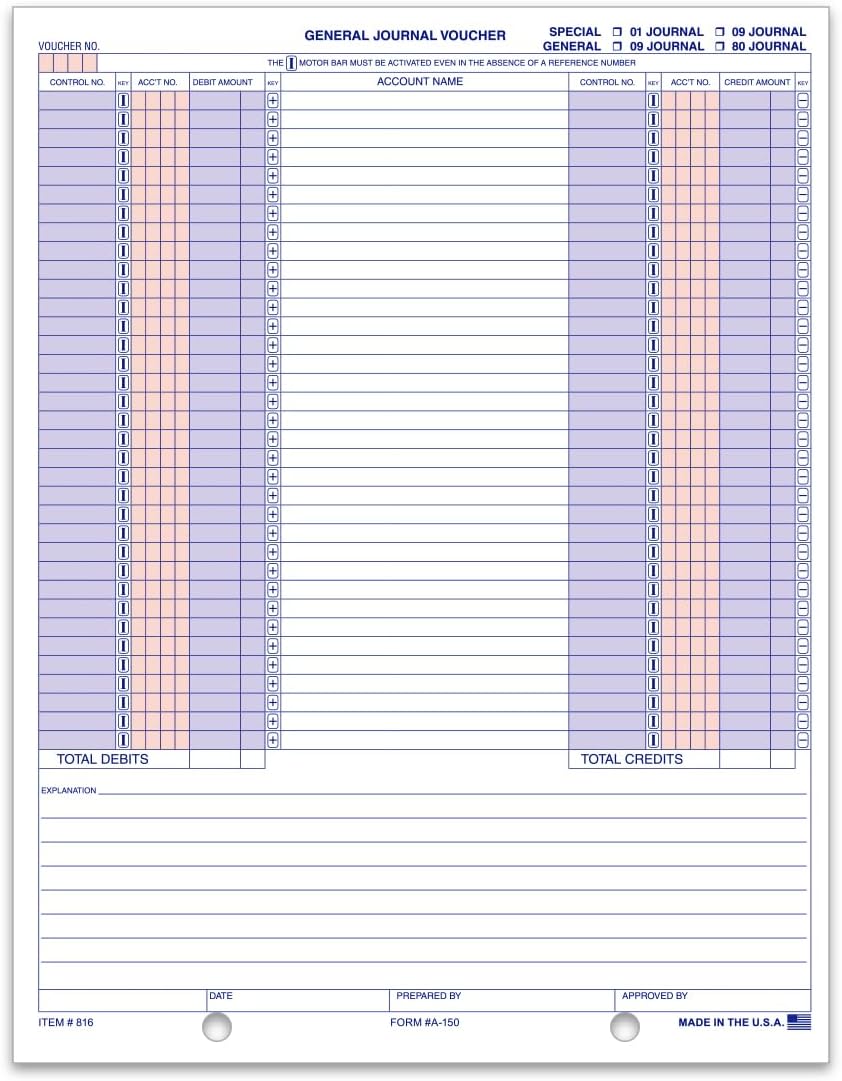

Form 150 Journal Voucher Expense Entry Pad

Brand: TOPS

Features / Highlights

- Provides a structured layout for consistent general journal entries.

- Helps maintain clear audit trails for expense approvals.

- Perforated sheets allow clean removal for filing or review.

- Printed form fields reduce manual formatting and recording errors.

- Durable paper stock prevents ink bleed and tearing during use.

CHECK PRICE

6

MoneyLine Personal Finance & Budget Manager

Brand: NCH Software

Features / Highlights

- Tracks personal bank accounts and credit activity in one place.

- Helps categorize spending for clearer monthly budgeting habits.

- Allows manual entry for cash expenses and non-digital transactions.

- Generates spending reports to review trends and overspending patterns.

- Simple interface reduces complexity for beginner users and non-technical individuals.

CHECK PRICE